property tax on leased car in ma

You can find these fees further down on the page. They are just different ways of financing.

Do Auto Lease Payments Include Sales Tax

Youll have to.

. Taxes are paid on motor vehicles every year based on their price. Do You Have To Pay Property Tax On A Car In Massachusetts. You can only drive so many miles each year in a leased car.

You will have to pay personal property taxes on any vehicle you do not register. There is an excise tax instead of a personal property tax. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment.

Most companies set a limit of 12000-15000 miles every year. The terms of the lease will decide the responsible party for personal property taxes. At the end of your lease you have the option to buy the car for a fee.

This may be a one-time annual payment or it may. View solution in original post. A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles.

Additionally you can look up the business with the Better Business. For vehicles that are being rented or leased see see taxation of leases and rentals. Registration gift tax transfer.

Who Pays The Personal Property Tax On A Leased Car This would apply whether you own or lease. LIMITATIONS OF A LEASE. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287.

To learn more see a full list of taxable and tax-exempt items. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Leasing a car usually costs less than financing one.

For a leased vehicle you will have to pay massachusetts 625 sales tax on the lease price which would be applied to your monthly payment. In all cases the tax assessor will bill the dealership for the taxes and the dealership will pay. The fee amount ranges from about 250 to 800 much of which is simply added profit for the dealer.

1 Best answer. June 4 2019 913 PM. Your cars worth will be taxed at 25 per 1000 dollars.

Massachusetts collects a 625 state sales tax rate on the purchase of all vehicles. In addition to taxes car purchases in Massachusetts may be subject to other fees like registration title and plate fees. Ask your honda dealer for information about the tax regulations in your state or contact the tax assessor office.

This page describes the taxability of leases and rentals in Massachusetts including motor vehicles and tangible media property. The average cost of DMV fees in Massachusetts is around 80 depending on the. In Massachusetts you can deduct the Motor Vehicle Excise Tax you paid on your vehicles.

Property Tax On Leased Car In Ma PRFRTY. Certificate of title transfer fee. When you lease a car you dont have to worry about the car losing value.

If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill. Motor vehicle annual inspection fee. This would apply whether you own or lease.

To find out about any complaints that have been filed with the Attorney Generals Office against the dealership you intend to buy or lease from visit the consumer complaint page on our website or contact the consumer hotline 617 727-8400. If the lease states that you are responsible for these taxes you will then receive a bill from the dealership. Or you can lease a different car.

Connecticut S Sales Tax On Cars

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Kamloops This Week January 13 2021 By Kamloopsthisweek Issuu

Faq Frequently Asked Questions Don Valley North Hyundai

Avoiding Lease Return Trouble Autotrader Ca

Lease Return Center Boch Toyota South

Avoiding Lease Return Trouble Autotrader Ca

Avoiding Lease Return Trouble Autotrader Ca

Avoiding Lease Return Trouble Autotrader Ca

Avoiding Lease Return Trouble Autotrader Ca

Avoiding Lease Return Trouble Autotrader Ca

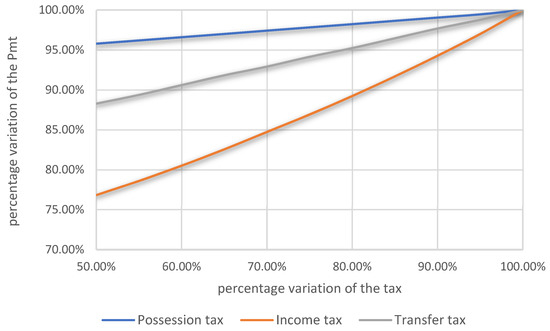

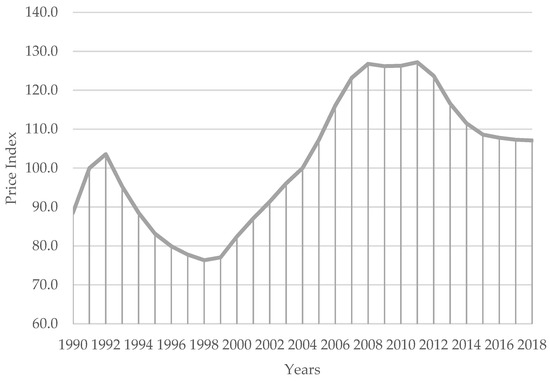

Buildings Free Full Text The Effect Of Taxation On Investment Demand In The Real Estate Market The Italian Experience Html

Buildings Free Full Text The Effect Of Taxation On Investment Demand In The Real Estate Market The Italian Experience Html

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Dave Ramsey Warns Against Paying A Hidden Interest Fee While Leasing A Car Getjerry Com